3 November 2025

Home > The Innovation League Table: Unveiling the UK’s R&D Powerhouses

3 November 2025

4 min read

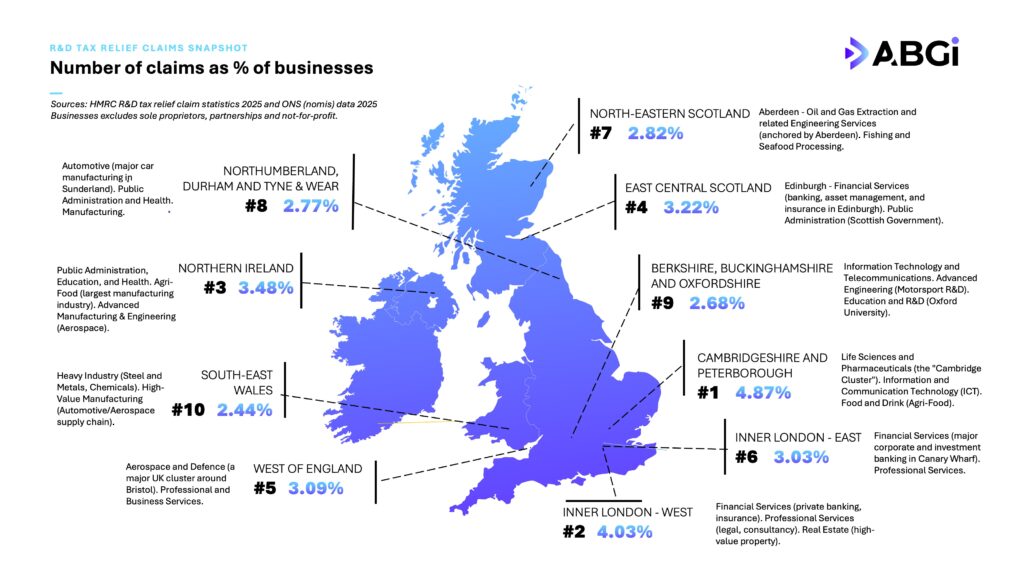

Our Innovation League Table ranks the nation’s top ten R&D hotspots based on claim intensity, revealing where business investment in science, technology, and engineering is strongest.

The UK economy relies heavily on research and development (R&D) to drive future growth and maintain global competitiveness. While much focus is placed on national investment, a deeper look at regional data reveals pockets of extraordinary innovation intensity across the country.

This Innovation League Table ranks the UK’s top ten regions / groups of counties by one key metric: the number of R&D tax relief claims filed as a percentage of all local businesses (excluding sole proprietors, partnerships, and not-for-profit organisations) in that area. This measure reveals where business investment in innovation is truly embedded in the local economic fabric.

Claiming the number one position is Cambridgeshire and Peterborough with an outstanding R&D claim rate of 4.87%.

Although Peterborough is generally considered the largest urban area by population, the success of Cambridge and the ‘Cambridge Cluster’ is intrinsically linked to its globally renowned research institutions.

The dominant industries driving this innovation are:

Two central London areas feature prominently, proving that innovation is not solely a manufacturing or science pursuit.

The league table showcases a strong performance from areas outside of England, highlighting significant investment in national centres:

Nothing really – neither the East or West Midlands made it into the Top 10. Herefordshire, Worcestershire and Warwickshire are number 12, Shropshire and Staffordshire are #14 with Derbyshire and Nottinghamshire at #15. The same applies to Yorkshire, with West Yorkshire at #16 and East Yorkshire at #17.

Innovation often clusters around specific industrial strengths:

This league table clearly illustrates that innovation in the UK is diverse, with regions specialising in everything from high-tech life sciences and engineering to financial services and traditional heavy industry. The common factor across all ten is a business community actively investing in R&D to secure their competitive future.

Sources: HMRC R&D tax relief claim statistics 2025 and ONS (nomis) data 2025. Businesses excludes sole proprietors, partnerships and not-for-profit.

If you have any questions relating to securing the right funding for your innovation projects, please get in touch with ABGi. A representative will get back to you to discuss your unique needs and explain how we can assist.