Home > Services > Innovation Tax Relief > R&D Tax Credits

R&D Tax Credits

ABGi simplifies the process with a start-to-finish service, combining deep technical expertise and compliance insight to help you claim confidently.

Home > Services > Innovation Tax Relief > R&D Tax Credits

The UK Government’s Research & Development (R&D) Tax Credit Scheme has been in place since 2000 to incentivise businesses to invest in projects focused on innovation. They are intended to support projects that seek to advance science or technology by resolving scientific or technological uncertainties.

Since 2000, there have been over 700,000 claims made, with a value of over £62 billion.

2000

UK introduces R&D tax relief

700,000

claims made since inception

£62 bn

total value of claims since inception

The scheme is open to Limited Companies only, whereas sole traders and partnerships are not included.

→ Software → Life sciences → Manufacturing

→ Agriculture → Oil and gas → Waste management

✅ developing new technologies

✅ improving processes

✅ or addressing environmental challenges

Even include the replication of a product, process, service, or device if it results in a significant improvement. According to HMRC, a company is engaged in R&D when they are seeking to achieve an advance in science or technology. The activities which directly contribute to achieving this advance in science or technology through the resolution of scientific or technological uncertainty are R&D. The ‘advance’ should not be easily discoverable by a skilled professional.

Encouragingly, R&D is still considered to have taken place regardless of whether the project was successful or not. The focus is on the “seeking” aspect.

Staff salaries

Employer’s NIC

Pension contributions

Materials

Consumables (e.g., heat, light, power)

Software

Data

Cloud computing (since April 2023)

Clinical trial volunteer payments

Capital expenditure may qualify if classified as intangible assets

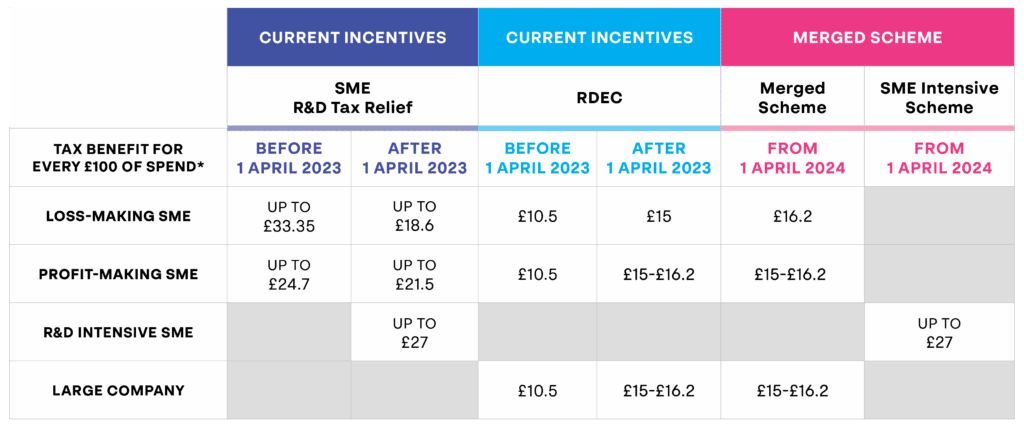

For accounting periods starting before April 1, 2024

Introduced for accounting periods starting on or after April 1, 2024, this scheme unifies the previous Small and Medium Enterprises (SME) and Research and Development Expenditure Credit (RDEC) schemes into a single framework applicable to all companies, regardless of size.

✔ A 20% taxable credit on qualifying R&D expenditure.

✔ Net benefit: 15% (at 25% corporation tax rate) or 16.2% (at 19% corporation tax rate) after tax.

✔ For profitable companies, the credit reduces tax liability; for loss-making companies, it can be surrendered for a cash payment, subject to the PAYE/NIC cap.

PAYE/NIC Cap: For loss-making companies, payable credits are capped at £20,000 plus 300% of PAYE and National Insurance contributions (NIC) liabilities.

This is a targeted relief for loss-making SMEs with high R&D intensity, introduced to support innovative startups and research-focused businesses.

→ SMEs (fewer than 500 employees, turnover under €100m, or balance sheet under €86m) that are loss-making.

→ R&D expenditure must be at least 30% of total expenditure (reduced from 40% in April 2024 to broaden access).

→ Must involve qualifying R&D activities resolving scientific or technological uncertainties.

✔ A 186% super-deduction on qualifying R&D expenditure, enhancing tax relief for losses.

✔ A 14.5% cash credit for losses surrendered, providing critical funding for loss-making SMEs.

✔ Subject to the PAYE/NIC cap (£20,000 + 300% of PAYE/NIC liabilities).

Eligibility:

→ SMEs undertaking qualifying R&D activities.

Benefits:

✔ A 186% super-deduction on qualifying expenditure (reduced from 230% before April 2023).

✔ Loss-making SMEs could surrender losses for an 18.6% cash credit (or 10% before April 2023, 14.5% for R&D-intensive SMEs from November 2023).

Status:

⏱︎ Replaced by the merged scheme for periods starting on or after April 1, 2024, but claims for earlier periods can be made within two years of the accounting period end.

Eligibility:

→ Large companies or SMEs ineligible for SME relief (e.g., those subcontracted by large companies).

Benefits:

✔ A taxable credit, increased to 20% from April 2023 (previously 13%).

✔ Net benefit after tax: 15% (at 25% corporation tax) or 16.2% (at 19% tax).

Status:

⏱︎ Replaced by the merged scheme for periods starting on or after April 1, 2024, but relevant for prior claims.

→ Small and Medium-sized Enterprises (SMEs) are defined as companies with fewer than 500 FTE employees and either total revenues lower than €100 million or total balance sheet assets lower than €86 million.

→ Large companies are generally defined as companies with 500 or more FTE employees, or those which have fewer than 500 employees but revenue in excess of €100 million and balance sheet assets greater than €86 million. If SMEs meet certain conditions, they may have to claim under the RDEC scheme (for accounting periods starting before April 1, 2024).

Determine Eligibility

✔ Is my business eligible?

✔ Do I have qualifying R&D activity?

✔ Which scheme applies to me?

Identify qualifying costs

(hopefully you’ve maintained detailed records)

Prepare a Technical Narrative

Complete the Additional Information Form (AIF)

Mandatory for all claims since August 2023.

Find out more about the AIF here

File your Corporation Tax Return

Submit Supporting Documentation

Click here for a more detailed breakdown of the claims process

These interactions can affect the type or amount of R&D tax relief a company can claim and its ability to access other funding. Click here for more information on how this might affect your claim