29 August 2025

Home > Creative Industries Tax Relief Statistics – 2025

29 August 2025

3 min read

HMRC has released the latest Creative Industries Tax Relief statistics for 2025. Discover which sectors gained, which dipped, and what the new AVEC and VGEC schemes mean for the future.

→ £2.40bn paid out in creative industries tax reliefs and expenditure credits in 2023–24 — up 9.6% from the previous year (£2.19bn).

→ High-End TV (HETV) Relief accounted for nearly half of the total value (46%), with Film Tax Relief (FTR) contributing 22%.

→ Strongest growth in Theatre Tax Relief (TTR) and Children’s TV (CTV), while Film Tax Relief saw a slight decline.

→ Track record: Since launch, FTR has supported 5,800+ films (£6.4bn) and HETV 1,650 programmes (£5.1bn).

→ AVEC & VGEC replacing old reliefs: Existing Film, HETV, Children’s TV, Animation, and Video Games Reliefs are being phased out — optional until 1 April 2025, mandatory from 1 April 2027.

These numbers include, for the first time, claims for the new Audio-Visual Expenditure Credit (AVEC) and Video Games Expenditure Credit (VGEC). Given that these new credits only apply to expenditure incurred from 1 January 2024, there were a limited number of claims for the 2023 to 2024 financial year. The figures below include claims from both the older tax reliefs and the new AVEC and VGEC schemes.

During the 2023 to 2024 financial year, creative industries tax reliefs and expenditure credits paid out a total of £2.40 billion, marking an increase (9.6%) from the £2.19 billion paid in the previous financial year (2022 to 2023).

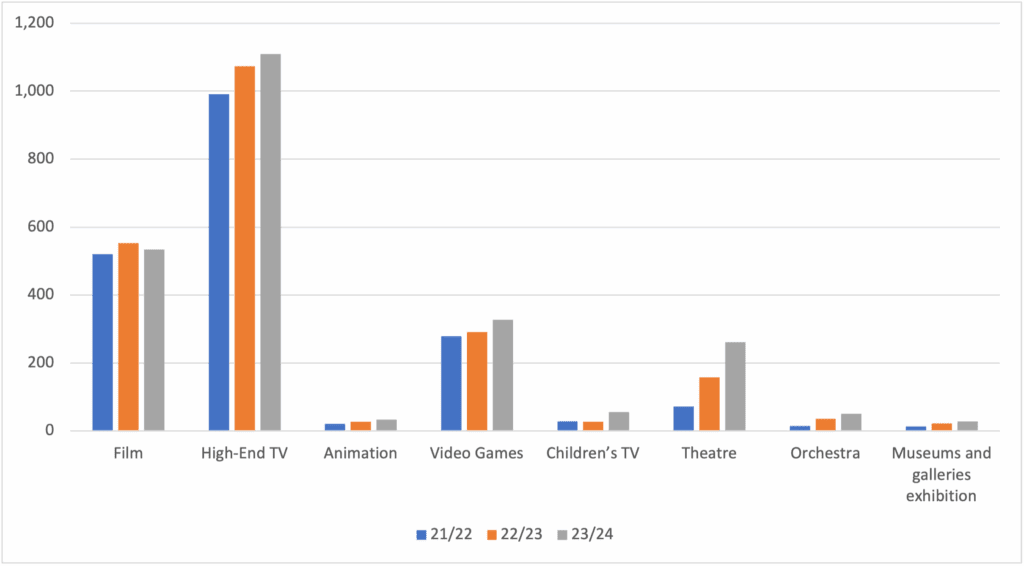

As shown in Table 1. below, most reliefs saw a modest increase in value.

The most significant proportional rises were in Theatre Tax Relief (TTR) and Children’s TV Tax Relief (CTV), while Film Tax Relief (FTR) experienced a slight decrease. For claims related to the 2023 to 2024 financial year, High-End TV (HETV) Tax Relief accounted for almost half (46%) of the total amount, with FTR making up 22%.

These proportions are consistent with the previous year. Since FTR was introduced in 2007, companies have made claims for 5,805 films and £6,438 million has been paid out. Since HETV tax relief was introduced in 2013, companies have made claims for 1,650 programmes and £5,053 million has been paid out.

Table 1 – Creative industries tax reliefs (£ million) paid – 21/22, 22/23, and 23/24.

The five existing audio-visual tax reliefs, which cover film, high-end television (HETV), children’s television, animation, and video games, are being discontinued. They are being replaced by new expenditure credits – AVEC) and the Video Games Expenditure Credit (VGEC).

There is a transitional period during which companies can choose to claim either the old tax reliefs or the new expenditure credits for their ongoing productions. However, for any productions that began on or after 1 April 2025, it is mandatory to claim under the new expenditure credits. All productions, regardless of their start date, must switch to the expenditure credits from 1 April 2027.

The most recent statistics are based on claims received up to 11 June 2025 and relate to accounting periods up to the 2023-2024 financial year. Only a small number of AVEC and VGEC claims were made during this period.

If you have any questions relating to Creative Tax Relief or wish to further discuss how it might benefit your own business, please get in touch with ABGi , and a representative will get back to you to discuss your unique needs and explain how we can assist.