30 October 2025

Home > R&D Tax Relief and Subcontracting: What Aerospace & Defence Companies Need to Know

30 October 2025

4 min read

The rules for subcontracted R&D have changed. Discover what the new merged scheme means for aerospace and defence supply chains, who can still claim, and how to stay compliant under HMRC’s updated framework.

Subcontracting is a familiar and necessary part of how innovation happens across the aerospace, defence, security and space sectors. Whether it’s SMEs supplying expertise to primes, or Tier 1s distributing complex R&D work across the supply chain, collaboration is often key to technological progress.

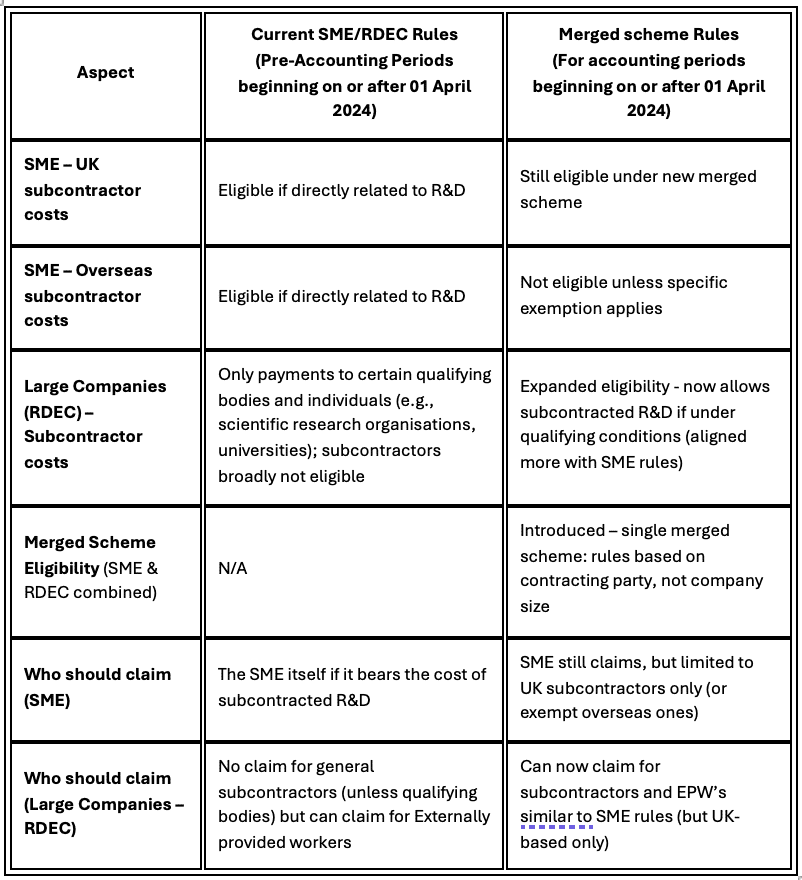

But from 1 April 2024, the rules governing how subcontracted R&D is treated for tax relief purposes have changed — and they now require far greater clarity around who can claim, what costs qualify, and where the work is carried out.

This article outlines the key changes and their implications for companies operating within the Aerospace & Defence sectors.

The former SME and RDEC schemes have been replaced by a single merged R&D scheme, with additional support for loss-making SMEs under Enhanced R&D Intensive Support (ERIS).

While the new scheme simplifies some areas, it also brings new challenges — especially for businesses involved in subcontracted R&D.

Under the new rules:

→ Only the company that initiates the R&D and bears the financial risk can claim relief.

→ R&D activities must be performed in the UK, unless a specific exemption applies.

→ Contracts must clearly demonstrate R&D intent at the time they are signed.

For many companies operating within the Aerospace & Defence sectors, the new framework affects existing claim strategies.

Complex multi-tier supply chains are common in aerospace and defence, and subcontracting often involves a mix of large primes, specialist SMEs, and research organisations.

The merged scheme shifts how eligibility works across these relationships:

This is not simply an accounting change. It’s an operational one too. Supply-chain contracts, resource allocation, and even IP ownership may need rethinking to ensure future eligibility.

If you’re involved in collaborative or contracted R&D, it’s worth reviewing your approach now.

1. Review your contracts – Make sure they explicitly refer to R&D objectives, technological uncertainties, and responsibilities.

2. Check where work takes place – Only UK-based activity qualifies unless you meet tightly defined overseas conditions.

3. Document R&D intent – Keep scopes of work, minutes, and evidence showing that R&D was planned at the outset.

4. Re-assess your claim methodology – The merged scheme changes who should claim and under what basis.

5. Seek advice early – Interpretation of subcontracting can be complex, particularly for mixed supply-chain projects.

For a deeper technical explanation, including worked examples and a checklist of subcontractor eligibility scenarios, download our white paper: R&D Tax Relief and Sub-Contracting – A Practical Guide

If you’re unsure how the new subcontracting rules affect your business, please get in touch with ABGi. Our consultants understand the complexity of multi-party R&D projects and the compliance challenges that come with them.